Through our Agri Food Growth Fund we led a €11m investment round in ChainCraft, please see the press release below:

Circular chemicals scale-up ChainCraft raised growth capital

ChainCraft, a Dutch scale-up active in circular chemical production is proud to announce it closed a EUR 11m funding round and secured the upcoming equity funding for its full scale flagship plant. ChainCraft produces circular chemicals from food waste through innovative fermentation technology, replacing fossil and palm oil based chemicals. For this round lead investor Convent Capital teamed up with existing investors Shift Invest, Horizon 3 and PDENH. ChainCraft will use the proceeds of this round to lay the groundwork for an industrial scale plant and to accelerate its growth plans in its existing Amsterdam demo plant.

Commercially, the Amsterdam based scale-up is gaining speed. Recently, ChainCraft announced a long term partnership with animal feed leader Agrifirm for the long term off take of circular fatty acids from its commercial demo plant. Offtake agreements with other partners from the feed and chemical industry for the demo and full scale plant will follow soon. It is becoming more and more apparent that these market players need to switch from environmentally high burden products based on crude and palm oil to more sustainable alternatives which ChainCraft is providing, with both the public as well as the regulator putting pressure on them.

Niels van Stralen (CEO & co-founder of ChainCraft): “We are very happy to welcome Convent Capital as new shareholder and are grateful with the continued trust and investment from our existing investors. Once again, our cost competitive, innovative and circular concept is supported by a strong consortium of financial partners and customers. We are only at the beginning of the transition to make the industry completely fossil and palm oil free. This investment will support and significantly speed up our journey towards this highly necessary transition towards circularity.”

Reynier Arendsen de Wolff from Convent Capital commented “this is an exciting opportunity for us. As an impact fund, we are always looking to support companies that have a commercial product and offer a price competitive, sustainable alternative to existing inputs. As ChainCraft has a unique way of upcycling biological waste, produces locally and replaces conventional products based on crude oil and palm kern oil, ChainCraft is a great contribution to our fund’s portfolio. Alongside capital, we expect that our experience as a long term investor in scaling organic waste recycling operations will help ChainCraft further accelerate their growth going forward”. Bart Raedts from Horizon 3 states “Horizon 3 has been involved in ChainCraft since 2012 and participated in all investment rounds to date. Horizon 3 has a strong believe in ChainCraft’s fermentation technology and products and is proud to be part of its journey towards a circular and biobased chemical industry.”

About ChainCraft

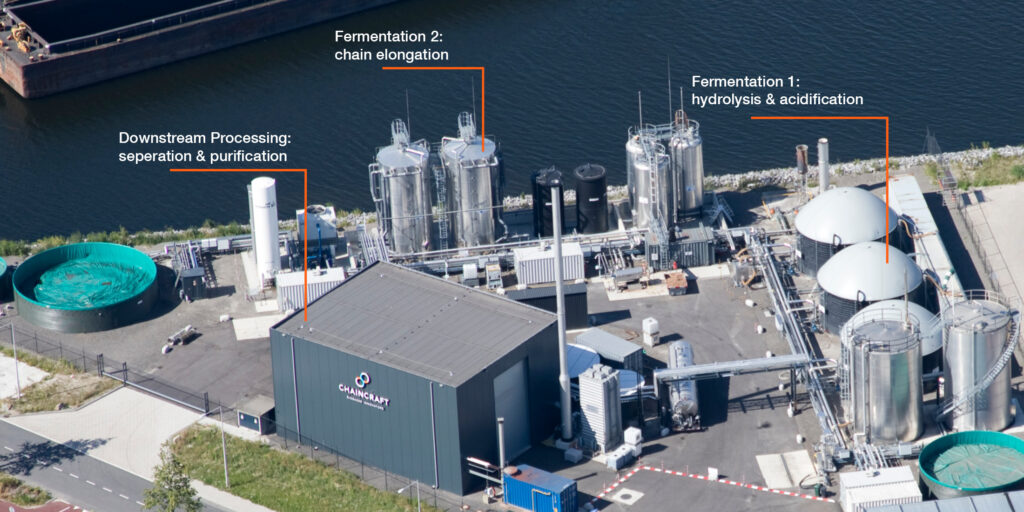

ChainCraft proves biobased chemistry can be circular and cost-competitive. We help industries move away from the use of fossil and palm oils, with bio-based chemicals made from food waste. Accounting for 14% of global greenhouse gas emissions and up to 9% of energy consumption, the chemical industry is one of the world’s most polluting industries. This is partly due to petro- and oleochemical companies increasingly exploiting fossil and palm oils, to meet the growing demand for fatty acids from agri-food, chemical and material industries. To support the transition away from fossil and palm oils, ChainCraft enables the chemical industry to tap into an alternative raw material: food waste. This resource is abundant: municipalities and agri-food industries produce over 200 million tonnes of food waste annually. Through a natural fermentation process, we transform food waste into medium-chain fatty acids (MCFA) and supply them to the agri-food, chemical & material industries. Fully circular, high quality and price competitive MCFA, while reducing greenhouse gas emissions up to 80% compared to the petrochemical and oleochemical processes. For more information: https://www.chaincraft.nl/

About Convent Capital

Convent Capital, founded in 2011, is an independent investment company from the Netherlands. Its first fund focused on Benelux-based SMEs with a strong track record and strategic and operational capabilities. Its new fund, Agri Food Growth Fund, brings growth capital to innovative and sustainable companies in the agricultural and food industries, and as an article 9 fund aims to generate a positive impact through every investment. Convent Capital has a strong focus on sustainability and believes in the transition from the current linear economy to a circular economy. The firm proves that companies that invest in this now will ultimately be the winners of the future. Its long-term strategy creates sustainable, high returns for its stakeholders.

About Shift Invest

SHIFT Invest is a Dutch venture capital fund that invests in innovations in food & agriculture, green and biobased industries, energy transition and smart mobility and logistics. Through its investments, SHIFT aims to fight climate change, biodiversity loss and the depletion of natural resources, in addition to a financial return. Together with the partners in the fund, SHIFT offers entrepreneurs a broad network and knowledge of various sectors. SHIFT consists of a diverse and experienced team of investment professionals and entrepreneurs with a clear mission: turning investments into impact

About Horizon 3

Horizon 3 is an investor in circular and biobased start- and scale-ups.

About PDENH

PDENH is an investment fund of €85 million from the Province of Noord-Holland, that invests in sustainable and innovative companies and initiatives. PDENH invests in companies and projects that focus on the energy transition, circular economy and sustainable mobility. To be eligible for a PDENH investment, it is important that business activities take place in Noord-Holland and that PDENH investments generate financial, economic and social returns. For more information: http://www.pdenh.nl/.